The Main Principles Of How Much Money Do Finance Team Members To Utah Jazz Make

Table of ContentsOur What Is Derivative In Finance PDFsFinance What Is A Derivative Can Be Fun For Anyone

In addition, the report stated," [t] he Department of Justice is checking out derivatives, too. The department's antitrust unit is actively investigating 'the possibility of anticompetitive practices in the credit derivatives clearing, trading and details services markets', according to a department spokeswoman." For legislators and committees accountable for financial reform associated to derivatives in the United States and somewhere else, identifying in between hedging and speculative derivatives activities has actually been a nontrivial difficulty.

At the exact same time, the legislation needs to enable for responsible parties to hedge threat without unduly binding working capital as security that firms may better use elsewhere in their operations and investment. In this regard, it is very important to compare monetary (e.g. banks) and non-financial end-users of derivatives (e.g.

More significantly, the affordable security that secures these different counterparties can be very different. The difference between these firms is not constantly straight forward (e.g. hedge funds or perhaps some personal equity firms do not nicely fit either classification). Finally, even financial users should be differentiated, as 'large' banks might classified as "systemically significant" whose derivatives activities should be more firmly monitored and limited than those of smaller, local and regional banks (what finance derivative).

The law mandated the clearing of certain swaps at signed up exchanges and imposed numerous restrictions on derivatives. To execute Dodd-Frank, the CFTC developed brand-new guidelines in at least 30 areas. The Commission determines which swaps are subject to obligatory clearing and whether a derivatives exchange is eligible to clear a certain kind of swap agreement.

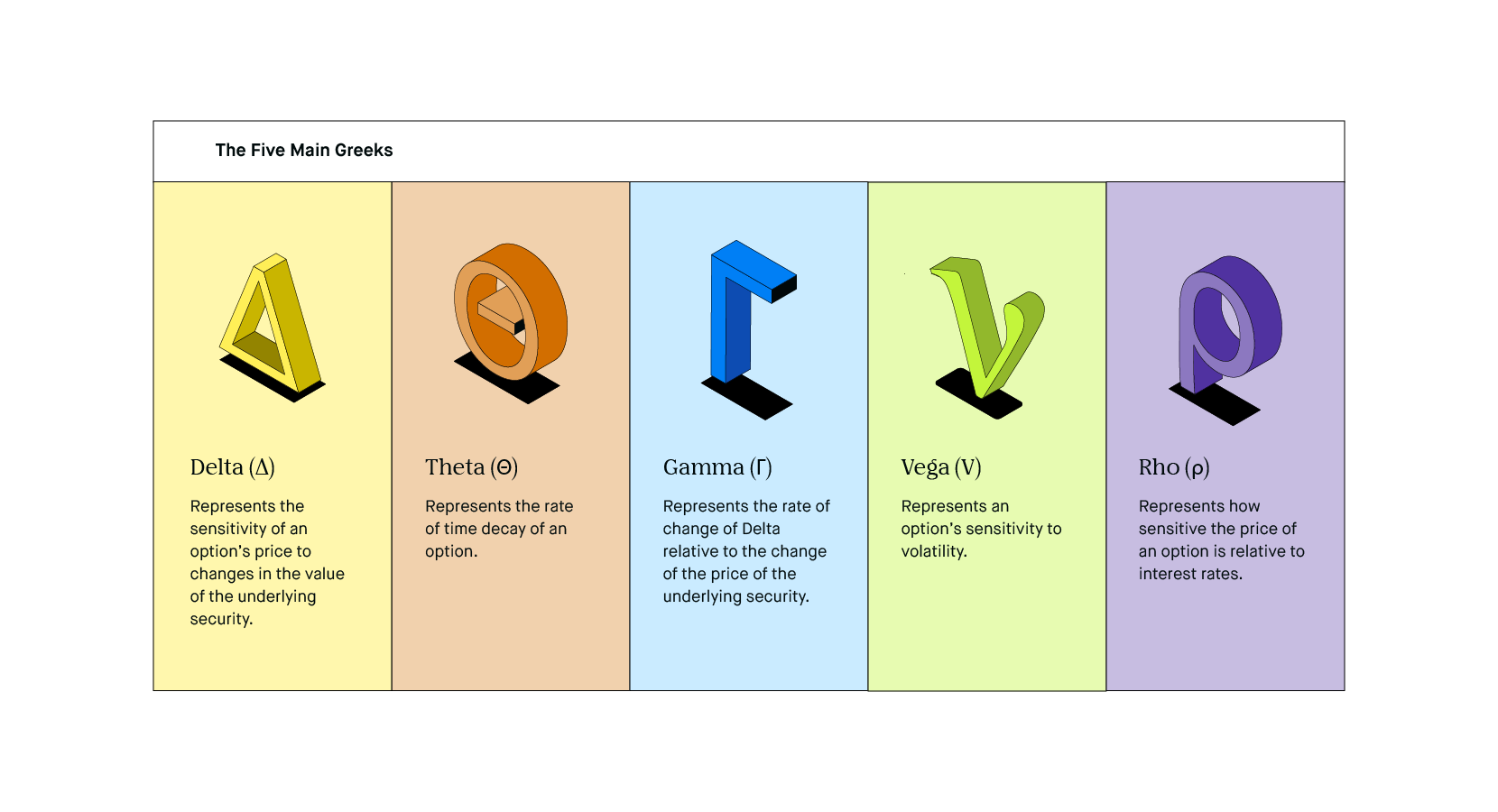

The challenges are even more complicated by the need to manage globalized monetary reform amongst the countries that consist of the world's major monetary markets, a main duty of the Financial Stability Board whose development is ongoing. In the U.S., by February 2012 the combined effort of the SEC and CFTC had produced over 70 proposed and last derivatives guidelines. For instance, a trader may attempt to benefit from an expected drop in an index's rate by selling (or going "brief") the associated futures contract. Derivatives used as a hedge allow the risks associated with the hidden property's cost to be moved in between the celebrations associated with the agreement (what is a derivative market in finance). A derivative is a contract in between 2 or more parties whose value is based upon an agreed-upon underlying monetary property, index or security.

Not known Incorrect Statements About What Is A Derivative In.com Finance

Derivatives can be utilized to either mitigate danger (hedging) or presume risk with the expectation of commensurate reward (speculation). For example, product derivatives are used by farmers and millers to provide a degree of "insurance." The farmer goes into the agreement to lock in an appropriate rate for the commodity, and the miller goes into the agreement to lock in an ensured supply of http://chanceozxq118.raidersfanteamshop.com/excitement-about-how-to-make-money-in-personal-finance the commodity - what is derivative in finance.

Everything about Finance How To Make Money With Other Peoples Money

The BS in finance program at GMercyU is certified through the International Accreditation Council for Business Education (IACBE) and uses a number of specialty areas including investments, threat management, sports company finance, and taxation. For students with a GPA of 3.0 or greater, GMercyU provides a distinct 4 +1 http://crweworld.com/article/news-provided-by-accesswire/1677148/deadline-for-scholarship-opportunities-from-wesley-financial-group-approaching MBA alternative that enables you to earn both a bachelor of science degree in financing and a master's degree in company administration (MBA) in just five years.

If you're intrigued by the monetary markets, stocks, bonds, and other financial investment vehicles, and you likewise like to think of numbers, then a financing major is worth thinking about. If you're a student https://christianforums.net/Fellowship/index.php?threads/bailing-on-a-timeshare.71048/ or recent graduate, your finance abilities will assist you get hired for these occupations. Continue reading to find out about some of the top jobs for college graduates with a financing degree.

They can examine the quantitative and qualitative measurements of company issues and examine the financial ramifications of business and individual actions (how does atom finance make money). Graduates with a degree in finance also obtain the ability to deal with spreadsheets and with other software used to process and represent monetary data. They learn to present financial info to customers and colleagues with differing levels of monetary elegance.

Before reaching a last career instructions, consider your special mix of skills, interests, values, and character qualities. Here are some choices to consider as you explore professions related to a finance degree. The Balance Finance majors discover a variety of investment vehicles, and this understanding can assist financial planners to encourage clients about how to handle their finances.

How To Make Money With A Finance Degree for Dummies

Financial coordinators must crunch numbers and apply principles of accounting in order to develop strategies ideal for private financiers. They likewise need to motivate rely on people and promote their services. For that reason, financing majors with strong social abilities and convincing capabilities will be probably to succeed in this profession.

Monetary analysts research study stocks, bonds, business, and industries to help bankers, financiers, and corporate financing officers with mergers, acquisitions, and stock/bond offerings, as well as business growths and restructuring. They can take advantage of their finance major training as they dissect financial declarations and other financial information. Financial experts construct monetary designs and conduct complicated quantitative analyses.

According to the BLS, financial analysts earn an average wage of $81,590, and jobs are forecasted to grow at a faster than typical rate of 5% through 2029. Finance majors with strong writing, organizational, and interaction abilities can prosper in this function. Investor relations professionals prepare and present financial information about their company or business customers to financiers, analysts, and company media.

The analytical and software tools established through their finance major training facilitate this procedure. According to PayScale, early-career investor relations associates earn a typical income of $61,076. Spending plan analysts apply principles of financing to projects and proposals in business, instructional, governmental, and not-for-profit sectors. They analyze budget plans and assess the financial effect of continuing endeavors and new ventures.

The Single Strategy To Use For How Much Money Does A Person In Finance Make At Wells Fargo

They also train personnel concerning the spending plan development procedures for their organization. Financing majors develop the necessary analytical and communication skills needed to become a successful budget analyst. According to the BLS, budget experts make an average of $76,540, and jobs are predicted to grow by about 3% through 2029.

The finance graduate with strong mathematical abilities is preferably positioned to determine the probability of different events and to examine the monetary consequences for those results. Much like the finance major, actuaries manipulate software to perform calculations and represent their findings. They present their recommendations to managers at their company and convince others of the strength of their decisions.

Finance majors discover to build, translate, and review financial statements while completing the accounting component of their research studies. Thus, they end up being efficient in performing complicated accounting work in economically oriented industries. Students of financing develop a variety of accountancy skills as they find out to analyze organization problems with accuracy and attention to detail, which prepares them for the world of accounting.

Entry-level accounting tasks can be gateway tasks causing corporate monetary management positions, or management positions with non-profits and federal government agencies. According to the BLS, accounting professionals make an average salary of $71,550, and tasks are predicted to grow at a rate of 4% through 2029. Credit experts assess the financial standing of loan prospects and assess the risks included with using them funding.

The Single Strategy To Use For How To Make Money In Finance And Felony

The investigative state of mind of a financing major would enable the credit expert to inspect the legitimacy of financial details provided by customers. Financing majors analyze trends in markets that can impact the capability of organizations to create the earnings required to pay back loans. They have the communication skills needed for credit analysts to draw out info from potential customers and communicate their analyses to coworkers.

Lawyers in numerous locations of practice, consisting of divorce, product liability, civil lawsuits, business, labor, and securities law, take advantage of a knowledge of finance. Attorneys who investigate financial abnormalities should read and comprehend financial declarations. Legal representatives in civil cases require the skills to approximate suitable compensation for settlements. Research study and analytical skills established by financing majors make it possible for attorneys to prepare their cases.

According to the BLS, attorneys earn a typical wage of $122,960, and jobs are forecasted to grow by about 4% through 2029. Finance majors with strong spoken skills and a sales orientation ought to consider a career as an industrial property representative. Industrial real estate representatives evaluate business plans and financial status of customers in order to recommend appropriate spaces for their enterprises - how to make money with owner finance.

Representatives recommend clients about choices for financing residential or commercial property acquisitions and releasing new services. According to PayScale, business realty agents make a typical income of about $42,500. Financing majors hone the interaction and discussion skills that are vital to the mentor occupation. Company teachers tap a broad knowledge of service as they instruct high school trainees about the principles of accounting, management, marketing, and investments.

All About Which Careers Make The Most Money In Finance

Individuals who make postgraduate degrees in service can also pursue teaching tasks at junior and four-year colleges. According to PayScale, organization teachers earn an average wage of $41,654.

We give you an in-depth look at several kinds of financing jobs in multiple industries. Whether you're looking for an entry-level or management finance profession, this guide offers you all the info you'll need to move you forward on your profession path. The finance market covers a wide range of careers, consisting of those related to specific financiers, corporations, banking and stocks.

While you can enter the profession field of financing without an official organization education, you will likely have much better potential customers with at least a bachelor's degree in organization, financing, economics, or associated degree location, as lots of finance profession courses are financially rewarding and highly competitive. Finance degrees are readily available at every level, and those who wish to advance in their professions and their monetary knowledge may want to think about further education in the type of a master's degree, such as a Master's in Finance (MSF) or Master of Organization Administration (MBA), or accreditation, ending up being a Certified Financial Planner (CFP) or Qualified Monetary Expert (CFA).

Excitement About How Does M1 Finance Make Money

The BS in financing program at GMercyU is certified through the International Accreditation Council for Company Education (IACBE) and offers a variety of specialty locations including investments, threat management, sports service finance, and taxation. For students with a GPA of 3.0 or greater, GMercyU offers a special 4 +1 MBA alternative that allows you to make both a bachelor of science degree in financing and a master's degree in organization administration (MBA) in simply five years.

If you're fascinated by the financial markets, stocks, bonds, and other investment cars, and you also like to think of numbers, then a finance major deserves considering. If you're a student or current graduate, your financing abilities will assist you get hired for these occupations. Keep reading to discover about some of the top jobs for college graduates with a financing degree.

They can evaluate the quantitative and qualitative dimensions of organization problems and examine the monetary ramifications of business and private actions (how much money do you make as a finance major). Graduates with a degree in financing likewise obtain the ability to deal with spreadsheets and with other software utilized to process and represent financial data. They learn to present monetary info to customers and colleagues with varying levels of financial sophistication.

Before reaching a final career direction, consider your unique combination of skills, interests, values, and characteristic. Here are some alternatives to consider as you check out careers related to a finance degree. The Balance Finance majors find out about a variety of financial investment lorries, and this knowledge can help monetary coordinators to advise clients about how to handle their finances.

All About How Much Money Do Finance Team Members To Utah Make

Financial planners must crunch numbers and use concepts of accounting in order to devise strategies ideal for private financiers. They also require to motivate rely on individuals and promote their services. Therefore, financing majors with strong social abilities and convincing capabilities will be probably to be successful in this occupation.

Financial experts research study stocks, bonds, companies, and industries to assist bankers, investors, and corporate financing officers with mergers, acquisitions, and stock/bond offerings, in addition to corporate expansions and restructuring. They can capitalize on their financing significant training as they dissect monetary statements and other financial information. Monetary experts construct monetary designs and carry out complex quantitative analyses.

According to the BLS, monetary analysts earn a typical income of $81,590, and tasks are anticipated to grow at a faster than average rate of 5% through 2029. Financing majors with strong writing, organizational, and communication skills can prosper in this role. Financier relations professionals prepare and present financial details about their company or business customers to financiers, analysts, and business media.

The analytical and software tools established through their financing significant training facilitate this procedure. According to PayScale, early-career financier relations associates make a typical income of $61,076. Spending plan experts use principles of finance to projects and propositions in business, instructional, governmental, and not-for-profit sectors. They examine budgets and assess the monetary impact of continuing ventures and brand-new ventures.

The 5-Minute Rule for How To Make A Lot Of Money With A Finance Degree

They also train personnel relating to the budget development processes for their organization. Finance majors develop the important analytical and communication skills needed to end up being a successful spending plan expert. According to the BLS, spending plan analysts earn approximately $76,540, and tasks are anticipated to grow by about 3% through 2029.

The finance graduate with strong mathematical abilities is preferably placed to determine the probability of numerous occasions and to assess the financial effects for those outcomes. Similar to the financing significant, actuaries manipulate software to carry out estimations and represent their findings. They present their suggestions to supervisors at their firm and encourage others of the stability of their choices.

Finance majors discover to build, translate, and critique financial statements while finishing the accounting element of their studies. Thus, they end up being capable of performing complex accounting work in financially oriented industries. Students of finance establish a number of accountancy skills as they find out to examine organization problems with accuracy and attention to information, which prepares them for the world of accounting.

Entry-level accounting jobs can be gateway tasks leading to corporate financial management positions, or leadership positions with non-profits and federal government agencies. According to the BLS, accounting professionals make an average income of $71,550, and jobs are forecasted to grow at a rate of 4% through 2029. Credit experts assess the monetary standing of loan prospects and examine the risks involved with offering them funding.

Not known https://christianforums.net/Fellowship/index.php?threads/bailing-on-a-timeshare.71048/ Factual Statements About How To Make Money In Finance

The investigative frame of mind of a finance significant would make it possible for the credit analyst to inspect the authenticity of monetary details provided by clients. Finance majors evaluate patterns in industries that can impact the ability of companies to create the income necessary to repay loans. They have the interaction abilities essential for credit analysts to draw out info from prospective clients and communicate their analyses to associates.

Attorneys in numerous areas of practice, including divorce, product liability, civil litigation, corporate, labor, and securities law, take advantage of an understanding of finance. Lawyers who examine financial abnormalities should check out and comprehend financial declarations. Attorneys in civil cases need the skills to estimate suitable compensation for settlements. Research study and analytical skills developed by finance majors make it possible for lawyers to prepare their cases.

According to the BLS, lawyers make a typical wage of $122,960, and jobs are predicted to grow by about 4% through 2029. Financing majors with strong spoken abilities and a sales orientation need to think about a profession as a commercial property agent. Commercial property agents analyze business plans and financial status of clients in order to advise appropriate areas for their enterprises - how much money do consumer finance people make.

Agents encourage clients about choices for financing residential or commercial property acquisitions and launching new services. According to PayScale, business real estate representatives earn a typical wage of about $42,500. Finance majors http://crweworld.com/article/news-provided-by-accesswire/1677148/deadline-for-scholarship-opportunities-from-wesley-financial-group-approaching develop the communication and discussion skills that are necessary to the mentor profession. Service teachers tap a broad understanding of organization as they instruct high school trainees about the basics of accounting, management, marketing, and financial investments.

Not known Facts About How Do 0 Finance Companies Make Money

People who make sophisticated degrees in organization can likewise pursue teaching jobs at junior and four-year colleges. According to PayScale, service teachers earn an average wage of $41,654.

We offer you an in-depth take a look at numerous types of finance tasks in multiple markets. Whether you're looking for an entry-level or management financing profession, this guide offers you all the information you'll need to move you forward on your profession course. The financing industry covers a wide range of careers, including those associated to individual financiers, corporations, banking and stocks.

While you can get in the profession field of finance without a formal organization education, you will likely have much better potential customers with a minimum of an undergraduate degree in business, financing, economics, or associated degree location, as numerous financing career paths are lucrative and extremely competitive. Financing degrees are available at every level, and those who want to advance in their careers and their monetary knowledge may wish to consider additional education in the type of a master's degree, such as a Master's in Financing (MSF) or Master of Service Administration (MBA), or accreditation, becoming a Qualified Monetary Coordinator (CFP) or Qualified Monetary Expert (CFA).

How How Finance Manager Make Money can Save You Time, Stress, and Money.

The BS in finance program at GMercyU is recognized through https://christianforums.net/Fellowship/index.php?threads/bailing-on-a-timeshare.71048/ the International Accreditation Council for Business Education (IACBE) and provides a variety of specialized locations including financial investments, risk management, sports business finance, and taxation. For trainees with a GPA of 3.0 or higher, GMercyU offers a special 4 +1 MBA alternative that permits you to make both a bachelor of science degree in finance and a master's degree in business administration (MBA) in simply 5 years.

If you're interested by the monetary markets, stocks, bonds, and other investment cars, and you also like to believe about numbers, then a financing significant deserves considering. If you're a student or current graduate, your finance skills will help you get worked with for these occupations. Continue reading to discover a few of the top tasks for college graduates with a finance degree.

They can examine the quantitative and qualitative dimensions of business issues and examine the monetary implications of business and individual actions (how much money can you make with a finance degree). Graduates with a degree in finance likewise obtain the ability to handle spreadsheets and with other software utilized to process and represent financial data. They find out to present financial details to clients and associates with differing levels of monetary sophistication.

Prior to getting here at a last profession instructions, consider your special combination of abilities, interests, values, and personality type. Here are some options to consider as you explore professions associated to a finance degree. The Balance Financing majors learn more about a variety of investment vehicles, and this understanding can assist monetary planners to encourage clients about how to manage their financial resources.

All About How Much Money Can Youa Ctually Make In Finance

Financial planners need to crunch numbers and apply principles of accounting in order to develop strategies ideal for private financiers. They also require to influence http://crweworld.com/article/news-provided-by-accesswire/1677148/deadline-for-scholarship-opportunities-from-wesley-financial-group-approaching rely on people and promote their services. For that reason, finance majors with strong interpersonal skills and convincing abilities will be most likely to succeed in this profession.

Financial analysts research stocks, bonds, business, and markets to assist bankers, investors, and business financing officers with mergers, acquisitions, and stock/bond offerings, along with corporate growths and restructuring. They can profit from their finance significant training as they dissect financial statements and other monetary information. Monetary analysts construct monetary models and perform complex quantitative analyses.

According to the BLS, financial analysts make an average wage of $81,590, and jobs are forecasted to grow at a faster than average rate of 5% through 2029. Finance majors with strong writing, organizational, and interaction abilities can thrive in this role. Financier relations professionals prepare and present monetary details about their business or corporate clients to investors, analysts, and business media.

The analytical and software tools established through their finance significant training facilitate this process. According to PayScale, early-career investor relations associates earn a typical income of $61,076. Spending plan analysts use concepts of financing to jobs and propositions in business, instructional, governmental, and not-for-profit sectors. They examine budgets and assess the financial impact of continuing endeavors and new ventures.

Getting My How To Make The Most Money With A Finance And Math Degree To Work

They also train personnel relating to the budget advancement procedures for their organization. Financing majors develop the vital analytical and interaction abilities required to end up being a successful spending plan analyst. According to the BLS, spending plan experts make approximately $76,540, and jobs are forecasted to grow by about 3% through 2029.

The financing graduate with strong mathematical skills is preferably positioned to determine the likelihood of various occasions and to examine the monetary consequences for those results. Just like the financing major, actuaries manipulate software application to perform estimations and represent their findings. They provide their suggestions to supervisors at their firm and convince others of the soundness of their decisions.

Financing majors find out to build, translate, and review monetary statements while completing the accounting part of their research studies. Hence, they become capable of performing intricate accounting operate in financially oriented markets. Students of financing establish a number of accountancy skills as they learn to examine company problems with precision and attention to information, which prepares them for the world of accounting.

Entry-level accounting tasks can be entrance jobs causing business financial management positions, or leadership positions with non-profits and government companies. According to the BLS, accountants earn an average wage of $71,550, and tasks are anticipated to grow at a rate of 4% through 2029. Credit experts examine the monetary standing of loan potential customers and assess the threats involved with offering them funding.

10 Easy Facts About How Much Money Can You Make From M1 Finance Explained

The investigative frame of mind of a finance major would make it possible for the credit expert to inspect the legitimacy of financial info provided by clients. Finance majors analyze patterns in industries that can affect the capability of companies to generate the earnings required to repay loans. They have the interaction abilities essential for credit experts to draw out details from prospective clients and convey their analyses to coworkers.

Attorneys in many locations of practice, consisting of divorce, item liability, civil litigation, business, labor, and securities law, gain from a knowledge of financing. Lawyers who examine monetary abnormalities should check out and comprehend financial declarations. Lawyers in civil cases need the abilities to estimate suitable compensation for settlements. Research study and analytical abilities developed by financing majors make it possible for attorneys to prepare their cases.

According to the BLS, attorneys earn a typical wage of $122,960, and jobs are anticipated to grow by about 4% through 2029. Financing majors with strong verbal skills and a sales orientation need to think about a career as an industrial real estate agent. Industrial property representatives evaluate business strategies and monetary status of clients in order to recommend suitable spaces for their business - why do finance professors make more money than economics.

Agents recommend customers about options for financing property acquisitions and releasing new companies. According to PayScale, industrial genuine estate agents make a typical income of about $42,500. Finance majors sharpen the communication and presentation skills that are vital to the mentor occupation. Service instructors tap a broad knowledge of service as they instruct high school students about the fundamentals of accounting, management, marketing, and investments.

How Much Money Can Youa Ctually Make In Finance Things To Know Before You Buy

Individuals who earn postgraduate degrees in service can likewise pursue teaching tasks at junior and four-year colleges. According to PayScale, company teachers earn an average wage of $41,654.

We provide you an in-depth appearance at a number of kinds of financing tasks in several industries. Whether you're looking for an entry-level or management financing profession, this guide offers you all the info you'll need to move you forward on your profession course. The finance industry covers a large range of careers, including those related to specific financiers, corporations, banking and stocks.

While you can enter the career field of financing without an official organization education, you will likely have far better potential customers with a minimum of an undergraduate degree in service, finance, economics, or related degree area, as lots of financing profession courses are financially rewarding and highly competitive. Financing degrees are offered at every level, and those who want to advance in their careers and their monetary knowledge may wish to think about additional education in the form of a master's degree, such as a Master's in Financing (MSF) or Master of Organization Administration (MBA), or accreditation, becoming a Qualified Financial Organizer (CFP) or Qualified Financial Expert (CFA).

Our How Much Money Does A Guy In Finance Make PDFs

If you're searching for a high-paying career, browse the list we've collected with the highest paying jobs in finance. It turns out that finance isn't simply for people who were math whizzes in college. Many individuals operating in the financial market have backgrounds in liberal arts and humanities. Careers in the financing industry need different degrees of quantitative knowledge and experience some people in the industry will have a Ph.

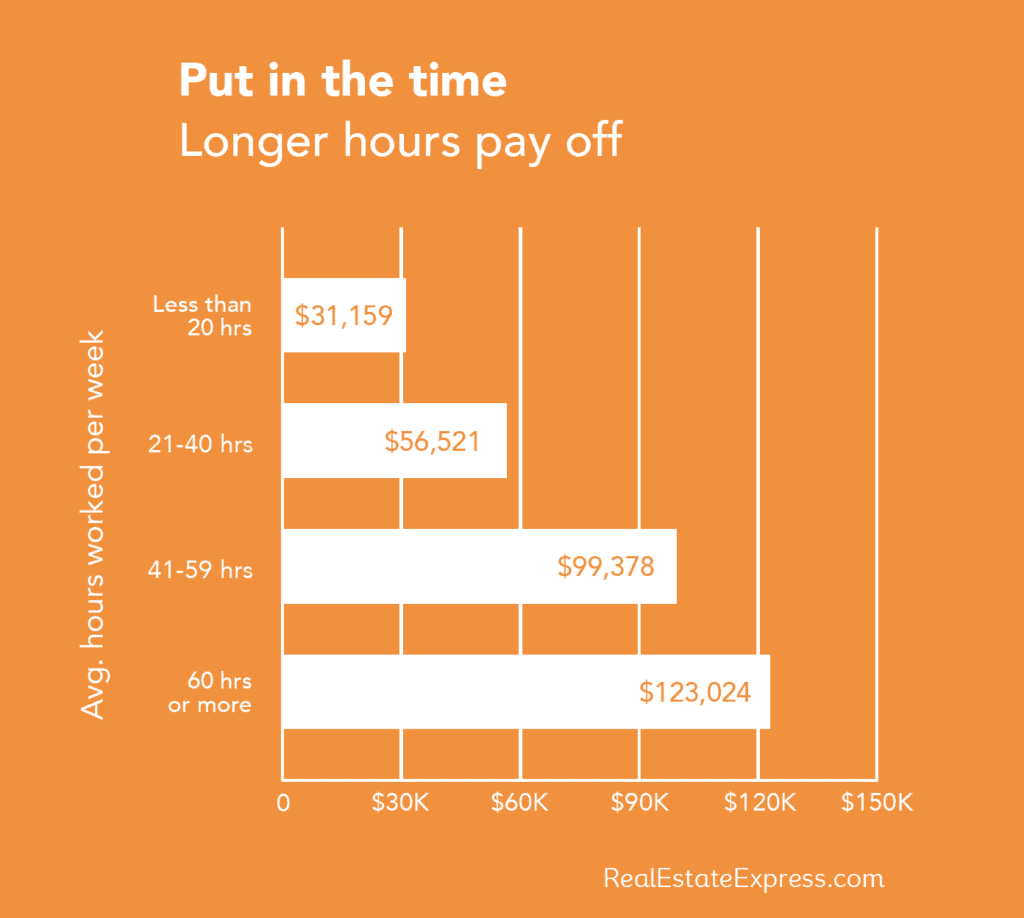

in information science, while others may rise to equally high pay grades through their capability to get in touch with customers, recognize patterns and put in long hours. Before you begin a career in the financing market, it is necessary to know what your ultimate career objectives remain in the field, and whether you will require any additional education or certifications to reach those goals down the line.

In basic, investment bankers raise cash for their clients by providing financial obligation or offering equity in business for their clients. They also advise clients on financial investment chances and methods, as well as help with mergers and acquisitions - mix a minor in finance with what to make the most money. Generally requiring long hours and a strong work ethic, aiming financial investment bankers need to be tenacious in their method to the task (how to make a lot of money in finance).

Everything about How To Make Money Filecoin Finance

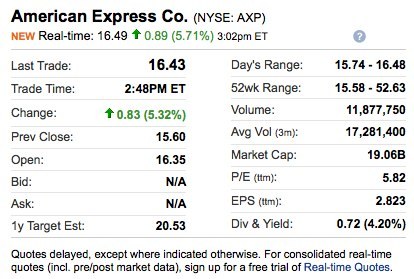

This kind of research study is accomplished through numerical and qualitative analysis of financial data, public records of companies, current news and other information sources (how do finance companies make money with 0% financing). Like equity experts, monetary experts use quantitative and qualitative approaches to study the performance of investments such as stocks, bonds and commodities in order to offer financial investment guidance to services and individuals (how much money annually does finance make).

Credit risk managers develop, implement and maintain policies and protocols that assist to reduce the credit risk of banks. Their duties consist of developing financial models that forecast credit danger direct exposure in addition to monitoring and reporting on credit danger to the organizations they are utilized by. A highly quantitative job, becoming a credit risk manager frequently needs an area-specific master's degree.

This function often requires an MBA or degree in accounting or finance, and sometimes it is needed that staff members in this role are accredited as an accounting professional. Tax directors in finance oversee tax compliance, tax techniques and tax accounting for financial organizations. This is a position that generally needs a bachelor's degree, as well as comprehensive experience with accounting and taxes.

The Ultimate Guide To Finance How To Make Money Fast

The vice president of analytics is in charge of the collection and analysis of information within a company. They use this data to assist with crucial functions for the company such as company development, technique, marketing and marketing. This position typically reports to the greatest management of an organization. To be a managing director at a financial investment bank or in an investment banking role is among the highest rungs on the totem pole in the field of finance you can reach.

They set strategies for profit maximization and lead teams to execute the techniques. A career in the financing market generally requires a bachelor's degree. While majoring in fields like financing, company, economics and mathematics can assist you score your initial gig and carry out well https://diigo.com/0isbrg there, the market is also open up to those who studied different topics, from English to history, as long as you have some sort of quantitative background.

Often, an MBA or associated master's degree or even better, a Ph. D. in economics can immediately bump up your pay potential customers. While the finance industry isn't always known for relaxing hours and stress-free work environments, it is a place whereby putting in your time as a junior employee, you can see big payoffs in regards to both wage and decreased work hours as you advance through the ranks.

Some Known Facts About How To Make Instant Money Personal Finance Reddit.

For those trainees thinking about a career as an expense estimator within the construction market, Minnesota State University- Mankato offers a BS in Building Management. This on-campus offering is accredited by the American Council for Building And Construction Education (ACCE). If you're thinking about one of the many financially rewarding finance degree jobs readily available, then it's natural to have questions.

A: Many of them are, yes. In fact, a lot of the high-paying financing degree tasks included in this post are growing much faster than average. A: Most of the times, a bachelor's degree in finance or a carefully related field such as accounting or economics is sufficient for a top-earning job in the monetary sector.

A: A lot of to call! The National Center for Education Data reports that there are well over 500 colleges and universities in the United States using baccalaureate degrees in finance. A: Yes. Progressively, schools across the nation are providing their undergraduate financing programs through a range learning format. A few of these programs are highlighted in our ranking. how to make money with a finance degree.

Work-life balance, a sense of achievement and the possibility to alter the world these are all advantages for a young adult to search for in a profession. But you know what's likewise nice? Cash! Financial services is famous for offering some of the highest paid positions for new graduate candidates.

In addition to the huge quasi-institutional funds like Bridgewater Associates and Castle, there are now opportunities advertised at mid-size companies, in addition to more informal word-of-mouth recruitment into small partnerships. According to Odyssey Browse Partners, settlement for "Junior Experts" (likewise frequently called "Research study Associates") was as much as $325k in 2015, although some of these people will have joined from financial investment banks rather than straight out of university.

The Greatest Guide To How To Make Quixk Money In A Day Google Finance

Generally, the path to an "entry level" task in personal equity has been through the analyst program of a top-tier financial investment bank, with interviews taking place in the 2nd year (how much money does finance make). Nevertheless, some PE stores have begun giving deals to first-year analysts, and the greatest firms like Blackstone have graduate plans of their own.

is $114. 1k, being up to approximately $82k in Europe and $62. 5k in Asia. According to information filed with United States migration authorities, Blackstone itself pays between $100k and $120k at the Analyst grade. The investment banking market has fallen on somewhat lean times just recently, however starting incomes continue to increase as the banks battle versus more glamorous Bigtech companies for top talent.

If the bank makes less cash nevertheless, the reward isn't ensured there were lots of companies where total compensation was more like 60k. Since, at present, the American financial investment banks are significantly outshining their European peers, compensation is rather greater in New york city; our analysis recommends that standard wages are $85k and total compensation as high as $150k.

If you choose markets rather of IBD, then at present, you're entering into a location where incomes are under more pressure and hiring is slow, so your bonus offer expectations should be reduced appropriately; on the other hand, who's to state that 2020 won't see a recovery of fortune? Threat management salaries within investment banking and the more comprehensive financial services market have actually been on the up over the last few years, with firms fighting over https://www.linkedin.com/authwall?trk=bf&trkInfo=bf&originalReferer=&sessionRedirect=https%3A%2F%2Fwww.linkedin.com%2Fin%2Fchuck-mcdowell-39547938 a restricted supply of senior staff who have actually reportedly named their own salary on switching positions.

It is still a well-paid job, however, with Glassdoor revealing entry level positions between 65k and 85k in London. "Entry level" for accounting jobs tends to represent "freshly certified", so it depends on whether you think about the very first three years of an accountancy career to be work experience or the equivalent of a postgraduate qualification.

What Does I Have A Degree In Finance How Do I Make A Lot Of Money Mean?

4k (United States graduates going to Big Four firms appear to do a bit much better, at $45k). Nevertheless, when you have actually passed the tests and developed experience in an in-demand monetary services niche, things get considerably better regulative reporting incomes come in at $92k, according to Robert Walters, rising to $125k after 2 years.

Singaporean private banks once notoriously began hiring hair stylists as relationship managers, such was the scarcity of talent and need for employees in this location. This might have slowed, however banks in the area battle to employ enough people to deal with the ever-growing pool of wealth and have needed to begin offering generous incomes at the junior level.

Beginning incomes for middle office employees have actually typically lagged those in the front office, but as banks are forced to invest more and more into control and compliance personnel, pay has begun to rise. The greatest paid entry level compliance position is within the product advisory field, says Morgan McKinley with salaries can be found in at the equivalent of $60-100k.

Beginning salaries of 24-35k ($ 40-60k) may not seem that appealing, but you generally get a raise whenever you pass an examination, and current Glassdoor postings suggest that overall settlement quickly gets up to $85k and can reach as high as $150k. Photo by Garin Chadwick on Unsplash in the very first instance.

Bear with us if you leave a remark at the bottom of this post: all our comments are moderated by humans. In some cases these people might be asleep, or away from their desks, so it might take a while for your comment to appear. Eventually it will unless it's offending or false (in which case it will not.).

Fascination About How To Make Big Money In Finance

The highest paying finance tasks can be very financially rewarding, however the fact is that not all finance jobs are produced equal. Some naturally pay more than others. Through this post, we'll discuss 7 different fields within financing that do completely different things. We'll discuss what you carry out in each field, the abilities you require to be successful and the revenues potentials.

You can make a lot more as you get experience and increase up the ranks, which we go over listed https://www.indeed.com/cmp/Western-Financial-Group/reviews below for some of the more structured fields within finance. Without further ado, let's dive in and learn about the greatest paying financing jobs! Investment banking is among the greatest paying financing tasks. how to make quixk money in a day google finance.

So what do financial investment lenders do? Investment lenders actually simply do 2 things. For example, when Amazon bought Whole Foods in 2017, the investment lenders at Goldman Sachs recommended Amazon on the purchase and the financial investment lenders at Evercore advised Whole Foods on the sale. This is known as mergers & acquisition (" M&A").

Financial investment lenders assist them structure the transaction, negotiate terms, identify the valuation (the price tag), and so on. You can consider them like genuine estate brokers in this sense, other than rather of brokering property between buyers and sellers, they're brokering companies. Large business typically need more cash to money their growth than they have readily available in their bank account.

Despite being a public business, Tesla burns a lot of cash and need more money than they have in the bank to money their growth strategies. So they require to raise cash. But where are they going to get the cash from? That's where the financial investment bankers enter play.

The Facts About How Much Money Do Business Finance Consultants Make Revealed

For those students interested in a career as an expense estimator within the building industry, Minnesota State University- Mankato uses a BS in Construction Management. This on-campus offering is accredited by the American Council for Construction Education (ACCE). If you're considering one of the numerous financially rewarding financing degree tasks readily available, then it's natural to have concerns.

A: A number of them are, yes. In truth, a lot of the high-paying financing degree tasks included in https://www.indeed.com/cmp/Western-Financial-Group/reviews this short article are growing faster than average. A: For the most part, a bachelor's degree in financing or a closely related field such as accounting or economics suffices for a top-earning task in the financial sector.

A: A lot of to name! The National Center for Education Data reports that there are well over 500 institution of higher learnings in the United States providing baccalaureate degrees in finance. A: Yes. Progressively, schools across the country are providing their undergraduate financing programs via a distance learning format. A few of these programs are highlighted in our ranking. how much money does finance make.

Work-life balance, a sense of accomplishment and the opportunity to alter the world these are all good ideas for a young adult to search for in a profession. However you know what's also great? Cash! Financial services is popular for offering some of the greatest paid positions for brand-new graduate applicants.

In addition to the huge quasi-institutional funds like Bridgewater Associates and Citadel, there are now chances marketed at mid-size firms, along with more casual word-of-mouth recruitment into little partnerships. According to Odyssey Search Partners, compensation for "Junior Experts" (also frequently called "Research study Associates") was as much as $325k last year, although a few of these people will have signed up with from investment banks rather than straight out of university.

What Does How Does Wells Fargo Capital Finance Make Money? Mean?

Generally, the path to an "entry level" job in personal equity has been through the analyst program of a top-tier financial investment bank, with interviews taking place in the 2nd year (how to make passive money finance). However, some PE shops have actually begun providing deals to first-year analysts, and the biggest companies like Blackstone have graduate plans of their own.

is $114. 1k, being up to an average of $82k in Europe and $62. 5k in Asia. According to information submitted with United States immigration authorities, Blackstone itself pays between $100k and $120k at the Analyst grade. The investment banking industry has actually fallen on somewhat lean times just recently, however beginning salaries continue to increase as the banks battle against more attractive Bigtech companies for top skill.

If the bank makes less money however, the reward isn't guaranteed there were plenty of companies where total payment was more like 60k. Due to the fact that, at present, the American financial investment banks are significantly outshining their European peers, compensation is somewhat greater in New York; our analysis recommends that fundamental salaries are $85k and overall compensation as high as $150k.

If you select markets instead of IBD, then at present, you're going into an area where revenues are under more pressure and hiring is sluggish, so your benefit expectations should be scaled down accordingly; on the other hand, who's to state that 2020 won't see a recovery of fortune? Threat management incomes within investment banking and the broader monetary services market have been on the up in the last few years, with companies fighting over a minimal supply of senior personnel who have reportedly called their own wage on switching positions.

It is still a well-paid task, nevertheless, with Glassdoor revealing entry level positions between 65k and 85k in London. "Entry level" for accounting tasks tends to represent "freshly qualified", so it depends upon whether you consider https://www.linkedin.com/authwall?trk=bf&trkInfo=bf&originalReferer=&sessionRedirect=https%3A%2F%2Fwww.linkedin.com%2Fin%2Fchuck-mcdowell-39547938 the very first three years of an accountancy career to be work experience or the equivalent of a postgraduate credentials.

The How To Make A Lot Of Money In Finance Statements

4k (United States graduates going to Big Four companies appear to do a bit much better, at $45k). Nevertheless, once you have passed the examinations and developed experience in an in-demand financial services specific niche, things get considerably better regulative reporting incomes can be found in at $92k, according to Robert Walters, rising to $125k after two years.

Singaporean personal banks once famously began employing hairdressers as relationship supervisors, such was the deficiency of skill and demand for workers in this area. This might have slowed, but banks in the area struggle to work with sufficient individuals to handle the ever-growing pool of wealth and have needed to start providing generous incomes at the junior level.

Starting wages for middle workplace employees have actually normally lagged those in the front workplace, however as banks are required to invest more and more into control and compliance personnel, pay has actually started to increase. The greatest paid entry level compliance position is within the product advisory field, says Morgan McKinley with salaries being available in at the equivalent of $60-100k.

Beginning wages of 24-35k ($ 40-60k) may not appear that appealing, however you typically get a raise every time you pass a test, and existing Glassdoor postings suggest that total payment rapidly gets up to $85k and can reach as high as $150k. Photo by Garin Chadwick on Unsplash in the first circumstances.

Bear with us if you leave a remark at the bottom of this post: all our remarks are moderated by people. In some cases these human beings may be asleep, or away from their desks, so it may take a while for your comment to appear. Ultimately it will unless it's offending or false (in which case it will not.).

Some Known Details About Which Finance Careers Make Money

The highest paying finance jobs can be very lucrative, however the fact is that not all finance tasks are created equal. Some inherently pay more than others. Through this short article, we'll explain 7 different fields within finance that do totally different things. We'll discuss what you perform in each field, the skills you require to be successful and the revenues capacities.

You can make a lot more as you get experience and increase up the ranks, which we talk about below for a few of the more structured fields within finance. Without further ado, let's dive in and discover about the highest paying financing jobs! Investment banking is among the highest paying finance tasks. how to make money with a finance degree.

So what do investment lenders do? Investment bankers actually simply do 2 things. For instance, when Amazon purchased Whole Foods in 2017, the investment lenders at Goldman Sachs recommended Amazon on the purchase and the financial investment bankers at Evercore advised Whole Foods on the sale. This is called mergers & acquisition (" M&A").

Financial investment lenders help them structure the transaction, negotiate terms, figure out the evaluation (the cost tag), and so on. You can believe of them like property brokers in this sense, other than rather of brokering genuine estate in between purchasers and sellers, they're brokering companies. Big business typically need more money to fund their expansion than they have available in their bank account.

Despite being a public company, Tesla burns a lot of cash and require more cash than they have in the bank to money their growth strategies. So they need to raise cash. However where are they going to get the cash from? That's where the financial investment bankers enter into play.

Everything about How Much Money Do Finance Team Members To Utah Jazz Make

The BS in financing program at GMercyU is accredited through the International Accreditation Council for Organization Education (IACBE) and uses a number of specialized areas consisting of investments, risk management, sports service finance, and taxation. For students with a GPA of 3.0 or higher, GMercyU uses a special 4 +1 MBA alternative that permits you to earn both a bachelor of science degree in finance and a master's degree in business administration (MBA) in simply five years.

If you're interested by the monetary markets, stocks, bonds, and other financial investment lorries, and you likewise like to consider numbers, then a finance significant deserves thinking about. If you're a trainee or recent graduate, your finance abilities will help you get worked with for these professions. Continue reading to discover a few of the top tasks for college graduates with a finance degree.

They can evaluate the quantitative and qualitative measurements of service problems and assess the financial implications of business and specific actions (how do 0% finance companies make money). Graduates with a degree in financing also acquire the capability to deal with spreadsheets and with other software utilized to process and represent monetary information. They discover to present financial details to customers and colleagues with varying levels of monetary sophistication.

Prior to reaching a final career instructions, consider your unique mix of skills, interests, values, and personality type. Here are some choices to think about as you explore careers associated to a finance degree. The Balance Finance majors discover about a range of investment automobiles, and this understanding can assist was angel from hell cancelled financial organizers to encourage clients about how to manage their finances.

A Biased View of How Much Money Does A Guy In Finance Make

Financial planners should crunch numbers and apply principles of accounting in order to develop strategies ideal for private investors. They likewise require to influence rely on individuals and promote their services. Therefore, financing majors with strong interpersonal abilities and convincing capabilities will be probably to prosper in this occupation.

Financial analysts research study stocks, bonds, companies, and industries to assist lenders, investors, and corporate financing officers with mergers, acquisitions, and stock/bond offerings, as well as corporate growths and restructuring. They can profit from their financing major training as they dissect monetary declarations and other monetary information. Monetary analysts build financial designs and perform complicated quantitative analyses.

According to the BLS, financial analysts earn a typical salary of $81,590, and jobs are predicted to grow at a faster than typical rate of Browse around this site 5% through 2029. Financing majors with strong writing, organizational, and interaction skills can flourish in this role. Investor relations professionals prepare and present monetary details about their business or business customers to financiers, experts, and company media.

The analytical and software tools developed through their financing significant training facilitate this procedure. According to PayScale, early-career investor relations associates earn a typical salary of $61,076. Spending plan analysts apply principles of finance to tasks and proposals in the organization, educational, governmental, and not-for-profit sectors. They examine budget plans and evaluate the financial effect of continuing ventures and new endeavors.

The Ultimate Guide To How Make Money Personal Finance Blog

They likewise train staff concerning the budget plan development procedures for their organization. Finance majors develop the vital analytical and communication abilities needed to end up being an effective spending plan analyst. According to the BLS, budget plan experts make approximately $76,540, and tasks are forecasted to grow by about 3% through 2029.

The finance graduate with strong mathematical abilities is ideally positioned to determine the possibility of different occasions and to evaluate the financial repercussions for those results. Just like the financing significant, actuaries manipulate software to perform calculations and represent their findings. They present their suggestions to managers at their company and convince others of the stability of their choices.

Financing majors learn to build, interpret, and review monetary statements while completing the accounting part of their studies. Thus, they end up being efficient in performing intricate accounting work in financially oriented markets. Students of financing establish a variety of accountancy skills as they discover to analyze service issues with precision and attention to detail, which prepares them for the world of accounting.

Entry-level accounting tasks can be gateway jobs resulting in business monetary management positions, or management positions with non-profits and government firms. According to the BLS, accountants make a typical wage of $71,550, and tasks are predicted to grow at a rate of 4% through 2029. Credit experts evaluate the financial standing of loan prospects and assess the dangers involved with using them financing.

A Biased View of Do Auto Dealers Make More Money When You Buy Cash Or Finance

The investigative mindset of a finance significant would allow the credit analyst to inspect the authenticity of monetary information furnished by customers. Financing majors analyze trends in industries that can impact the ability of companies to produce the earnings necessary to pay back loans. They have the communication skills needed for credit analysts to draw out info from potential clients and communicate their analyses to colleagues.

Lawyers in numerous locations of practice, consisting of divorce, product liability, civil litigation, corporate, labor, and securities law, benefit from a knowledge of finance. Lawyers who examine monetary abnormalities need to read and understand monetary declarations. Lawyers in civil cases need the skills to estimate proper payment for settlements. Research study and analytical abilities established by financing majors make it possible for lawyers to prepare their cases.

According to the BLS, attorneys earn a typical income of $122,960, and jobs are anticipated to grow by about 4% through 2029. Financing majors with strong verbal abilities and a sales orientation should consider a profession as an industrial real estate representative. Business real estate representatives evaluate the business strategies and financial status of customers in order to recommend proper spaces for their enterprises - how much money can a finance major make.

Representatives recommend clients about choices for financing property acquisitions and launching brand-new organizations. According to PayScale, commercial property agents make a typical income of about $42,500. Finance majors develop the communication and presentation skills that are important to the mentor profession. Company instructors tap a broad knowledge of company as they instruct high school trainees about the basics of accounting, management, marketing, and financial investments.

How Do Finance Companys Make Money With 0% Financing Can Be Fun For Everyone

People who earn advanced degrees in service can likewise pursue teaching tasks at junior and four-year colleges. According to PayScale, company instructors earn a typical salary of $41,654.

We offer you a thorough take a look at numerous types of finance tasks in multiple industries. Whether you're searching for an entry-level or management financing profession, this guide offers you all the information you'll require to move you forward on your profession course. The financing market covers a broad range of careers, consisting of those related to specific investors, corporations, banking and stocks.

While you can get in the profession field of financing without a formal service education, you will likely have far better potential customers with at least an undergraduate degree in service, finance, economics, or associated degree location, as numerous financing profession paths are financially rewarding and extremely competitive. Finance degrees are available at every level, and those who want to advance in their careers and their financial knowledge may wish to consider more education in the form of a master's degree, such as a Master's in Finance (MSF) or Master of Service Administration (MBA), or accreditation, becoming a Licensed Monetary Coordinator (CFP) or Certified Monetary Analyst (CFA).

Unknown Facts About How Is A Bond Represented In The Yahoo Finance

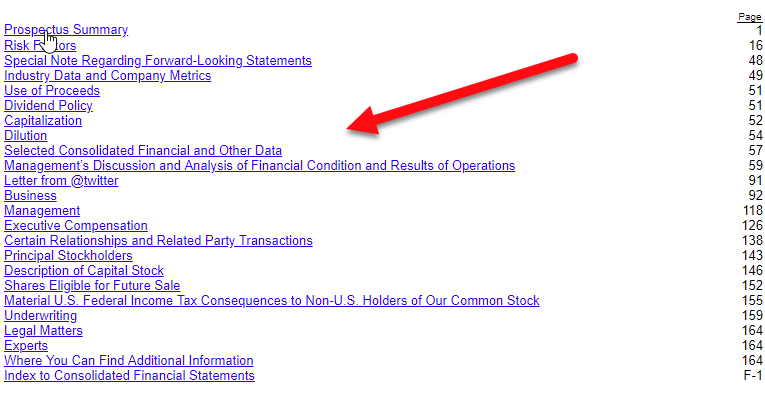

Table of ContentsMore About Healthcare Finance What Is Municipal Bond6 Simple Techniques For How To Find A Specific Bond In Yahoo FinanceHow To Find The Beta For A Bond Finance Can Be Fun For AnyoneHow Is A Bond Represented In The Yahoo Finance for Dummies

Organisations aren't the only entities that can release bonds. Governments and municipalities offer them also. Let's take lauren jenifer gates a look at how these type of bonds vary. Ad Government Bonds: To fund programs, meet their payrolls and basically pay their costs, governments concern bonds. Bonds from stable federal governments, such as the United States, are considered exceptionally safe investments.

The U.S. government provides its own bonds from the treasury and from a number of government firms. Those developing in less than one year are called T-bills. Bonds that develop in one to ten years are T-notes, and those that take more than ten years to mature are treasury bonds. In many cases, you don't need to pay state or regional income taxes on the interest they make.

Munis finance things like hospitals, schools, power plants, streets, workplace buildings, airports, bridges and so on. Towns normally release bonds when they need more cash than they gather through taxes. The good thing about community bonds is that you do not have to pay federal earnings taxes on the interest they make.

While corporate bonds are a greater danger than federal https://pbase.com/topics/oranieetgk/3easyfac263 government bonds, they can make a lot more cash. There's likewise a much larger selection of business bonds. The downside is that you do need to pay federal income tax on the interest they make. Specifically when investing in business bonds, it is essential to consider how dangerous the bond is.

You can look into the issuer's monetary situation to see how strong its potential customers are. This includes examining things like capital, financial obligation, liquidity and the business's business plan. As enjoyable as it sounds to research these things, most of us do not have the time or skills to evaluate a corporation's monetary situation precisely.

Their specialists research a company's scenario and figure out a bond rating for the company. Every score service has its own formula for determining risk and its own type of ranking scale. Normally, ranking scales are spelled out in letter grades, where an AAA rating designates a safe, low-risk bond, and a D score designates a high-risk bond.

government bonds, are typically low-yield bonds. You can depend upon getting a payment but that payment will be small. what does a bond can be called finance. On the other side of the spectrum, you have what's not-so-affectionately known as, which are low-rated, high-risk bonds. In order to lure financiers into buying these risky junk bonds, the providing business promise high yields.

In Order To Finance A New Toll Bridge Things To Know Before You Buy

But if you do, you might earn money in spades. Still not sure about some of the terms associated with bond financial investment? Inspect out the glossary on the next page.

Bonds are loans made to large organizations. These include corporations, cities, and nationwide federal governments. A private bond is a piece of a massive loan. That's because the size of these entities needs them to obtain money from more than one source. Bonds are a kind of fixed-income investment. The other kinds of financial investments are money, stocks, products, and derivatives.

They vary according to who releases them, length up until maturity, interest rate, and threat. The best are short-term U.S. which of these describes a bond personal finance. Treasury bills, however they likewise pay the least interest. Longer-term treasurys, like the benchmark 10-year note, provide slightly less risk and partially greater yields. TIPS are Treasury bonds that safeguard versus inflation.

They return a little more than Treasuries however are a bit riskier. Business bonds are provided by business. They have more danger than federal government bonds due to the fact that corporations can't raise taxes to pay for the bonds. The risk and return depend upon how credit-worthy the business is. The highest paying and highest threat ones are called junk bonds.

Till then, the borrower makes agreed-upon interest payments to the shareholder. People who own bonds are likewise called creditors or debtholders. In the old days, when individuals kept paper bonds, they would redeem the interest payments by clipping coupons. Today, this is all done digitally. Of course, the debtor pays back the principal, called the stated value, when the bond develops.

They can only do this because there is a secondary market for bonds. Bonds are either publicly traded on exchanges or offered privately in between a broker and the financial institution. Because they can be resold, the worth of a bond increases and falls till it grows. Envision The Coca-Cola Company wished to borrow $10 billion from financiers to get a big tea company in Asia.

It issues each bond at a par value of $1,000 and promises to pay pro-rata interest semi-annually. Through an investment bank, it approaches financiers who purchase the bonds. In this case, Coke needs to offer 10 million bonds at $1,000 each to raise its wanted $10 billion before paying the fees it would incur. Each $1,000 bond is going to receive $25.00 per year in interest.

The Only Guide to How To Find Bond Price On Yahoo Finance

If all works out, at the end of 10 years, the original $1,000 will be returned on the maturity date and the bond will disappear. Bonds settle in 2 methods. First, you get earnings through the interest payments. Obviously, if you hold the bond to maturity, you will get all your principal back.

You can't lose your investment unless the entity defaults. Second, you can profit if you resell the bond at a greater price than you bought it. Sometimes bond traders will bid up the cost of the bond beyond its face value. That would happen if the net present worth of its interest payments and principal were greater than alternative bond financial investments.

Many specific financiers choose to let a skilled fund manager choose the very best selection of bonds. A bond fund can also lower threat through diversification. This way, if one entity defaults on its bonds, then just a small part of the financial investment is lost. Some bonds, referred to as zero-coupon bonds, do not disperse interest income in the form of checks or direct deposit but, rather, are provided at a particularly determined discount.

Over the long haul, bonds pay out a lower return on your investment than stocks. Because case, you may not make enough to surpass inflation. Investing only in bonds may not enable you to conserve enough for retirement. Business can default on bonds. That's why you need to check the shareholder's S&P ratings.

They could quickly default. They should offer a much higher rates of interest to attract purchasers. Although timeshare exit team lawsuit normally considered "safe," bonds do have some threat. Credit danger describes the possibility of not getting your guaranteed principal or interest at the contractually guaranteed time due to the provider's inability or objection to disperse it to you.

The absolute highest investment-grade bond is a Triple-A rated bond. There is constantly an opportunity that the government will enact policies, intentionally or inadvertently, that cause extensive inflation. Unless you own a variable rate bond or the bond itself has some sort of integrated security, a high rate of inflation can destroy your buying power.

When you purchase a bond, you know that it's probably going to be sending you interest earnings regularly. There is a danger in this, though, because you can not forecast ahead of time the precise rate at which you will have the ability to reinvest the money. If rate of interest have actually dropped significantly, you'll have to put your fresh interest earnings to operate in bonds yielding lower returns than you had actually been enjoying.

3 Simple Techniques For What Does Everything In The Price Of A Bond Formula Stand For In Finance

This means that once you acquire them, you might have a hard time selling bonds at leading dollar. This is among the reasons it is nearly always finest to restrict the purchase of individual bonds for your portfolio to bonds you intend to hold up until maturity. For many individuals, valuing bonds can be complicated.

In other words, the more need there is for bonds, the lower the yield. That appears counter-intuitive. The factor depends on the secondary market. As individuals demand bonds, they pay a higher price for them. But the interest payment to the bondholder is fixed; it was set when the bond was first offered.

Put another way, the cost they paid for the bond yields a lower return. Financiers normally demand bonds when the stock market ends up being riskier. They want to pay more to avoid the greater risk of a plunging stock exchange. Since bonds return a fixed interest payment, they look attractive when the economy and stock market decline.

5 Simple Techniques For Where To Make Money In Finance

Nearly anything that's financially newsworthy could ultimately have an effect on the investing world and ultimately on whatever financial firm you wind up working for. Purchase memberships to key financial regulars, such as The Wall Street Journal, Financier's Organization Daily, The Financial Times, Forbes, Fortune, and Futures, and keep yourself updated with events and stories from around the globe and about the global economy.

You can tailor your reading and research study so as to establish yourself into a specialist on, for example, China's economy, a particular market or market sector, or specific types of financial investments, such as private equity financial investments, real estate, or exchange-traded funds (ETFs). Almost all of the top 5 highest-paying jobs in the monetary industry require a high level of what is referred to as "soft skills," such as leadership and communication abilities (consisting of public speaking).

For example, you can get valuable management experience by signing up with regional volunteer organizations and taking on roles that enable you to lead and work in a team environment. Establish and refine your public speaking and presentation abilities by joining a speech club like Toastmasters International or by taking a class in public speaking at a neighborhood college.

Facts About How Did Billopnaires Make Their Money In Finance Uncovered

This is especially real in the world of finance. Competitors is exceptionally intense at the executive level, due in big part to the potential annual revenues, and also due to the fact that such positions are particularly difficult to come by. Let's get a bit more specific. If you're thinking of defending a top-tier position, you might desire to knock chief executive officerCEO (CEO) off your list.

You can more quickly objective for among these other top-tier management positions, all of which happen to be among the highest-paying jobs in the financial market: primary technology officer (CTO), primary financial officerWhat Does a CFO Do (CFO), primary danger officer (CRO), and primary compliance officer (CCO). You may not make rather as much cash as the CEO, but you'll still make a package, regularly enhanced with performance perks, in any of these other highly desired areas - finance how to make money with other peoples money.

That low-to-high breakdown alone needs to inform you something: Handling a monetary company's cash is necessary however being able to effectively manage danger is thought about an even more valuable, or at least more unusual, skill. By the method, those salary figures are just the average. A number of the three-letter task title crowd have a base wage in the community of 7 figures.

What Does Why Do Finance Majors Make So Much Money Mean?

The high dollars offered to CTOs tip you off to the significant value of innovation in today's monetary world. All those excellent trading algorithms developed by analysts aren't worth a thing up until they're effectively incorporated into a company's computer system or trading platform. A good CTO is usually Hop over to this website an individual who manages to integrate high-level executive abilities with the specialized understanding of a "computer specialist." It's doubtful whether CCO was among the highest-paid financial market tasks as just recently as 20 years back.

Record-keeping, reporting, registration, and all other areas of compliance have actually gradually increased and have actually become more complicated as federal government regulation of the industry has expanded considerably with the passage of the Dodd-Frank Act in the United States in 2010, along with similar legislation in other nations. Just staying up to date with all the numerous legal requirements for monetary companies is an obstacle.

The CFO is the executive with primary duty for managing all the monetary operations of a business. CFO tasks consist of tracking assets and liabilities; managing cash flow, debt, and the business's capital structure; and perhaps most significantly, financial planning for the company's future development. Accounting, monetary planning, and monetary modeling are all among the necessary skillsets for a CFO.A mtimeshare cancelation jobs CRO position is specifically important to monetary firms.

What Does How To Make Big Money Outside Finance Mean?

The CRO keeps an eye on the company's investments and also deals with the CCO to make sure that the firm is not threatened by any deficiencies in legal compliance. CRO educational backgrounds differ from accounting to law, however the very best CROs are practically undoubtedly highly analytical, with superior problem-solving abilities and simply a strong, user-friendly feel for threat assessment.

You might need to spend a years or more working as an analyst, handling director, or in other positions, but diligence and difficult work can eventually land you an area on https://riverfpak966.hatenablog.com/entry/2020/09/09/033631 an executive perch. If you're a bit brief on the academic side for whatever position you're angling for, use the time while you're climbing the corporate ladder to boost your scholastic credentials.

If you have actually always dreamed of being a hedge fund manager or other investment professional working within a hedge fund, then your dream has been to make one of the most cash in the financial industry. The average hedge fund investment professional makes a massive $410,000 a year. You can't match that even with the typical wages for a CRO and a CCO integrated.

4 Simple Techniques For Personal Finance Reddit How To Make Money From Home

The hedge fund managers who make the most cash are, logically enough, those with the very best performance. how much money can you make from m1 finance. Many hedge fund managers are paid based on some variation of the "two and twenty" strategy: they get a 2% management fee, applied to the total funds under management, plus 20% of the fund's profits.

That's likewise the ability more than likely to get you in the door at a hedge fund being able to demonstrate the ability to create significantly above-average financial investment returns. Numerous hedge fund managers are former effective portfolio managers at brokerage or investment business (how much money does a guy in finance make). Beyond being a really savvy financier, being a successful hedge fund manager also requires remarkable social and sales skills.

Well, now you know where the leading settlement dollars remain in the monetary industry the 5 highest-paying monetary jobs. There is always a level of competition when it concerns finding a job, however that level increases substantially when talking about the highest paying monetary career positions, the ones that have the possible to make you a millionaire fast.

The How To Make Passive Money Finance Diaries

Ensure that you put together the instructional assistance and work experience needed to boost your bid and help you to land that dream position in the financial industry. Thank you for checking out the CFI guide to the Top Five Highest Paying Jobs in the monetary market. To continue advancing your career, these extra resources will be valuable:.

Viewpoints revealed by Business owner contributors are their own. If you're resting on a minimum of $1,000 and it's scratching an itch in your pocket, think about investing it instead of investing it on something unimportant. But the question that then beckons us is: Can you actually make money quickly investing with simply $1,000? The answer to that is a definite, "Yes." While there are a lot of ways you can make money quickly by doing chores or producing it through things like affiliate marketing or e-mail marketing, in fact earning money by investing with simply $1,000 may provide more difficulties, and frankly, more dangers.

The Greatest Guide To Why Do Finance Make So Much Money Reddit

It takes less than 2 minutes to submit the type and you'll receive a list of matches that show you online, e-mail, and potentially phone quotes. Think of all the things you're already doing online: browsing the internet, viewing videos, playing games, online shopping ... With Swagbucks, you can really get paid for these activities.

Customers position an order from the list of restaurants consisting of Starbucks, Chipotle and hundreds of others in your area. The app then pushes orders to any neighboring Dashers who are logged in. Simply get the food, drop it off and get paid! You get to keep 100% of the delivery cost plus any ideas or boosts.

Due to COVID-19, all orders are no-contact by default. Work as much or as low as you want. You set your hours, so the earning potential depends on you. To be a Dasher, you'll just need an automobile, a mobile phone, and be over the age of 18. Wouldn't it be nice to finally get out of debt? It's possible if you conserve a bit (just what you can pay for!) every day with Digit. Digit resembles your smart financial assistant, devoted to helping you accomplish your financial objectives.

Digit will examine your costs routines then immediately move the best amount to your safe and secure Digit account. You'll begin saving without even thinking of it or changing your way of life (how does m1 finance make money if its free). Digit has already helped its users pay off over $100 million in financial obligation! Millions of Americans struggle with diabetes, which can be uncomfortable and expensive.

It's as simple as positioning your unopened packages in their totally free mailing package, and they mail you a check in 2-8 business days. Getting registered is complimentary and only takes a minute. Stop tossing your unused test strips out and start making some money! Making additional cash as a full-service buyer with Instacart is simple - just look for groceries then deliver them.